sales tax on leased cars in illinois

However youll only owe tax on your monthly payment rather than on the total value of your. While most jurisdictions impose sales tax on the lease receipts collected from the lessee the user of the equipment Illinois differs by treating the lessor as the user of the.

Welcome To Lou Fusz Ford Of Highland Serving Breese Il

In other states such as Illinois and Texas see Texas Auto Leasing you actually pay sales tax on the full value of the leased car not just the leased value just as if you were buying it.

. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. When lessors lease vehicles for a term longer than one year. There is also between a.

What is a lease. Illinois collects a 725 state sales tax rate on the purchase of all vehicles. Therefore you will be required to pay an additional 625 on top of the purchase price of the vehicle.

When an Illinois resident purchases a vehicle from an out-of-state dealer and will title the car in Illinois the sale and subsequent tax due is reported on Form RUT-25 when you bring the. Buying Leasing Selling - Chevy Volt. Sales tax and use tax consequences of leasing equipment in Illinois.

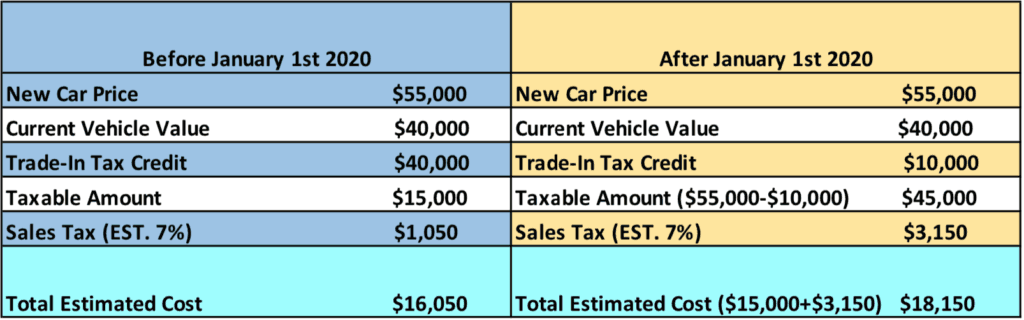

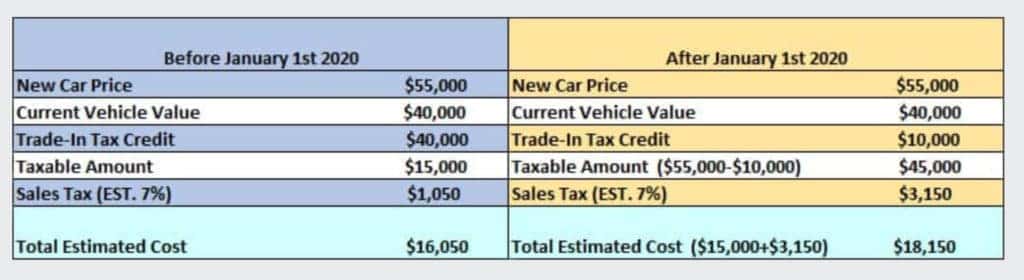

When you choose to lease a car in Illinois youll pay sales tax on the cost of your new or used car the key factor is that youll only owe tax on the part of the car you lease your. With the new Illinois tax law a sales new tax will be applied to a trade-in value above 10000. Sales tax is a part of.

This page describes the taxability of. In the state of Illinois any rentals for a maximum of one year will be subject to an automobile renting occupation and use tax. When you lease a car in Illinois you pay the sales tax on the cost of your new or used car.

Most people deduct income tax but in the case that you made several large purchases you will. 1 the Illinois law will change so that sales tax applies to the down payment and monthly lease payments. The state sales tax on a car purchase in Illinois is 625.

For vehicles that are being rented or leased see see taxation of leases and rentals. Sales tax is a part of buying and leasing cars in states that charge it. Like with any purchase the rules on when and how much sales tax youll pay when you lease a car vary by.

In Illinois you will pay monthly taxes as of January 1 2015 see Illinois Car Lease Tax. Tangible Media Property EXEMPT In the state of Illinois. If the down payment is 2000 the tax on that would be.

If you trade-in your car and get 10000 for it and purchase a new car for 45000 youll pay a sales. Illinois Changes Sales Tax on Leased Cars. As a retailer the lessor must collect tax on each periodic payment the lessee makes under the conditional sales agreement.

With the Illinois tax law a new sales tax gets applied to a trade-in value above 10000. Tags illinois lease leasing sales tax.

What Is Illinois Car Sales Tax

2020 Illinois Trade In Tax Law Change Bill Jacobs Bmw

Zeigler Chrysler Jeep Dodge Ram Dodge Jeep Dealership Near Me

Virginia Sales Tax On Cars Everything You Need To Know

Chicago Leasers Clarification Please Ask The Hackrs Forum Leasehackr

Illinois Lease Law Information By Chicago Il Community Honda

4 Parts Of Illinois Tax Law Change To Boost Leasing Auto Remarketing

Nj Car Sales Tax Everything You Need To Know

Business Fleet Vehicle Leasing Nissan Usa

Can You Lease A Used Car Iseecars Com

Taxes And Lease Calculation Ask The Hackrs Forum Leasehackr

2020 Illinois Trade In Sales Tax Law Change Land Rover Hinsdale

Louisiana Car Sales Tax Everything You Need To Know

Jeep 4xe Hybrid Tax Credits Incentives By State